Tax Configuration

In this guide, you will learn how to create and modify tax rates, ensuring accurate tax collection and compliance.

Last updated May 22, 2024

Create and modify tax rate

Tax rate is a percentage determined by local tax laws, applied to the amount of food and beverage products or services purchased by customers to calculate the taxable amount. The main purpose of setting tax rates in a restaurant system is to ensure correct tax collection from consumers and to ensure that the restaurant pays the corresponding taxes to the government in accordance with the law. Setting tax rates in a restaurant system is crucial as it ensures compliant operations, improves tax management efficiency, enhances customer trust, and establishes accurate financial records.

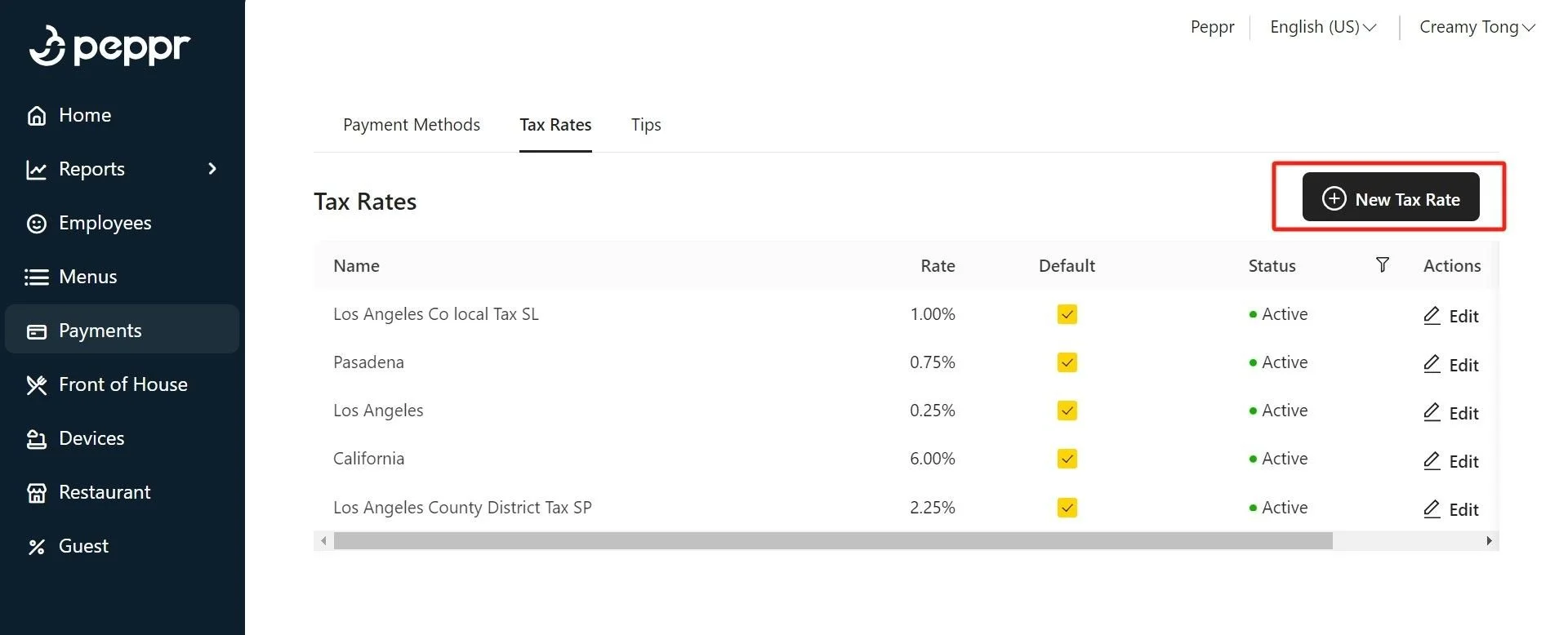

If you want to configure tax rates, you can do in Peppr as follows:

1. New tax rate creation

In Peppr website, navigate to Payments > Tax rates and click ➕ New tax rate.

Enter the basic information of the tax rates : Name, Type, Rate.

Click to select the tax rounding option and whether it needs to be set as the Default option. The tax rate set as the Default option will be automatically inherited by default when creating a new menu.

You can also directly click Default on the page.

Click Save when finished.

2. Tax rate modification

Click Edit in the Action section to modify tax rates.

Click Save and publish any changes.